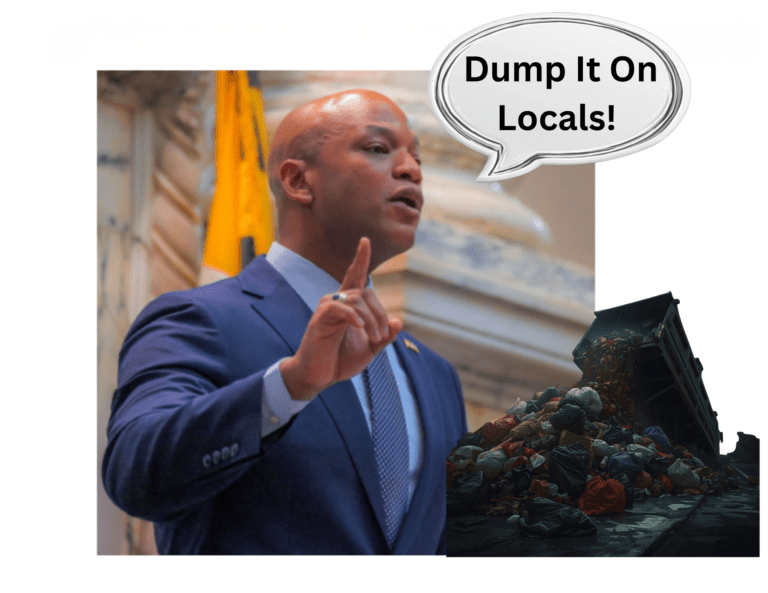

If there is any phrase one could use to describe Maryland Governor Wes Moore’s FY27 budget, it would be “dump it on the locals.” And we do mean dump in the most graphic way.

Moore knows he has a massive problem in FY 27. Maryland has a huge 1.9-billion-dollar deficit and might be facing a larger one of $2.6 billion in the upcoming year. That is a deficit he cannot blame on former Governor Larry Hogan or President Trump. He has to put on his big boy pants, suck it, up and solve the problem.

But, as is typical with Moore, his proposed solution is not real. It’s an imaginary one as real as Moore’s bronze star, his Oxford doctoral thesis, and his “autobiography.” All of it, a house of fake cards meant to protect him and fellow Democrats, not the citizens of Maryland. As we know, when you build a house of cards it often fails. It might fall on Moore’s national political aspirations.

So he made sure to shift the cost downstream in a nasty, smelly, fiscal dump.

Moore’s FY 27 budget shifts more costs to local governments primarily by moving responsibility for certain state‑mandated programs and services down to the county level, as part of a broader strategy to close a multibillion‑dollar deficit without raising taxes.

After all, Moore promised he wouldn’t raise taxes. Not in an election year.

The broader strategy involves cutting costs, one of the most obnoxious being extraordinarily large cuts to disability services—roughly $150 million cut in state funding to the Developmental Disabilities Administration (DDA). These reductions directly affect programs serving disabled children, including autism services, in‑home supports, respite care, and crisis intervention. These cuts also trigger the loss of over $150 million in federal matching funds, doubling the real impact to $300 million.

Advocates describe the cuts as a “gut punch” to families of children with autism and other developmental disabilities.

Funding was returned to 2024 funding levels in FY 26. Now DDA will experience more cuts on top of last year’s.

Advocates have warned in the past that children with autism, cerebral palsy, and complex developmental disabilities are now at risk of losing “critical services that safeguard their progress, safety, and hope for a meaningful life.”

Another way that Moore will prevent a tax increase statewide is by forcing tax increases locally. He is pushing parts of the state’s expensive Blueprint education debacle to locals, requiring them to pay MORE for education mandates many don’t need or want.

Counties such as Talbot, which already has to pay more than 60% of the county’s education programs because of state’s unfair, punitive funding formula towards certain counties, may no longer be able to protect their citizens from unwieldy tax increases. (The State is punishing Talbot for NOT increasing property taxes as much as the state has wanted in the past.) The county’s share of education funding is one of the top in the state.

Add to that the fact that locals will now have to bear more of the retirement costs for state employees and teachers, and it is a financial nightmare for local jurisdictions.

Moore also proposes shifting more highway and infrastructure project costs to locals as well as funding for detention centers, behavioral health services and emergency response.

What does this mean? Counties either have to raise taxes or cut services. They will have to deal with budget uncertainty mid-year, making it harder for them to create budgets for the upcoming year.

Remember, it’s all about political cover for Wes Moore.

Some counties will be affected more than others. Montgomery, Prince George’s Baltimore County, Anne Arundel and Howard Counties will absorb significant impacts even though those counties voted heavily for Moore in the last election. They are also the counties which will be heavily impacted by absorbing the costs of state retirees. Montgomery County alone will owe tens of millions of dollars.

Maryland historically paid the full employer share of teacher pensions.

Smaller, rural counties will feel the hit also because they have a smaller tax base and less flexibility in moving funds around.

What about Talbot County?

State cost shifts make it harder for Talbot to fund infrastructure, emergency services, public safety, and facility upgrades without delaying or scaling back projects.

Already, the Talbot County Public Schools is requesting an additional $9.6 million dollars ABOVE the required local share from county government. The district’s total unrestricted budget is projected to rise to $90.9 million, an increase of $9.4 million over FY26. Driving this is the Blueprint scam which includes a stand mandated minimum teacher salary of $60,000 by July 2026. That will be $4.2 million of the new budget in FY 27 alone. There will also be higher health insurance costs.

And while it is great to give teachers a salary boost, the boost of entry level teachers won’t be limited to them. The increase will work its way up the salary food chain so that ALL TCPS employees could see comparable pay raises. No wonder the Teachers’ Union wants this so badly. They want more dollars to donate to Democrat politicians.

Meanwhile, academic scores remain flat or regress on recent state testing, even though education will consume a larger portion of the county budget. Again, this will limit flexibility to fund other county departments such as public safety, public health, and infrastructure as the county absorbs a larger share of costs for pensions and rising service demands. This without proportional increases in state aid.

Ultimately, the county will have to consider higher tax rates but can only do that by following Maryland’sYield Tax Ratelaw, found in the Annotated Code of Maryland, Tax–Property Article §6‑308. This law requires a very specific process for implementing tax increases which include notice publications and public hearings. Citizens of Talbot County have not been in favor of increases and certainly a large local increase on top of Maryland’s massive tax and fee increases implemented by the Democrat super majority in the General Assembly last year will make the topic more volatile locally.

It will also cause more people to leave the county and the state. Already, the state has lost over 2 million people in the last decade. Public schools have lost over 11,000 students. From MARYLAND MATTERS:

High housing costs are driving people out of Maryland, new state report finds – Maryland Matters

While this is going on, Wes Moore leaves the Governor’s Mansion and travels all over the country campaigning for higher office. He portrays himself as an immensely popular and effective state leader. He is none of the above. It’s almost laughable.

He’s just another ladder climbing progressive Democrat trying to make his way to the White House by pretending to care about people. In reality, in his own words, he doesn’t give a ****. That is clear. He won’t even deal with his own budget “dump.”

For Other Articles on Governor Moore:

Wes Moore : Lightweight Liar – The Easton Gazette

Maryland Gov. Wes Moore Falsely Claimed To Be Bronze Star Recipient – The Easton Gazette

-Jan Greehawk, Author

The post Moore’s Budget Dump Idea: Shift The Burden To Local Government appeared first on The Easton Gazette.